{Stephanie} is a strategic experience designer based in Tokyo. View her past {experience}, or {contact} her here.

{Stephanie} is a strategic experience designer based in Tokyo. View her past {experience}, or {contact} her here.

Boosting Leads with Omni-Channel Design

MoneySmart

Boosting Leads with Omni-Channel Design

MoneySmart

Year

2019

Category

Service Design

Year

2019

Category

Service Design

The Challenge

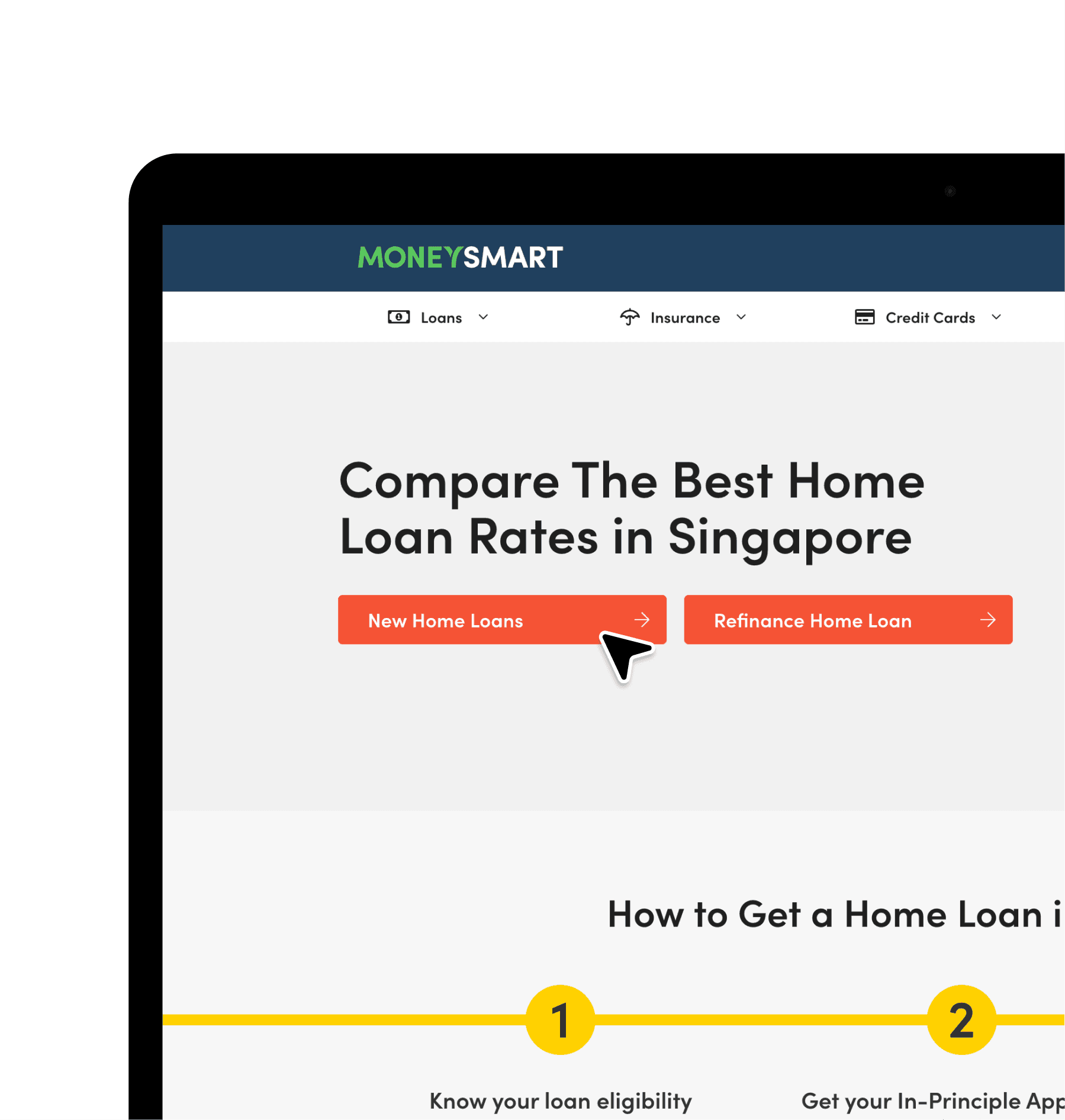

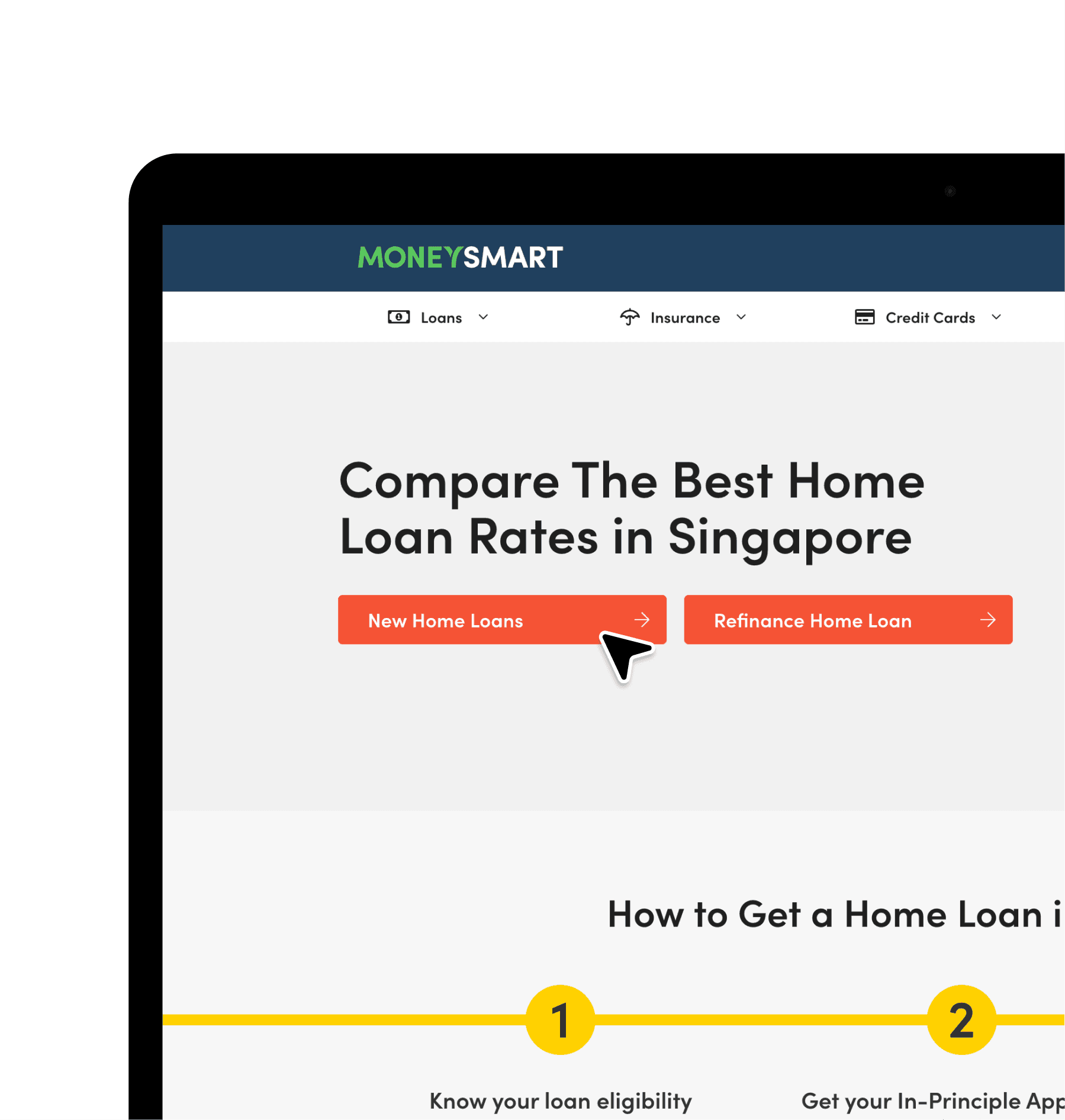

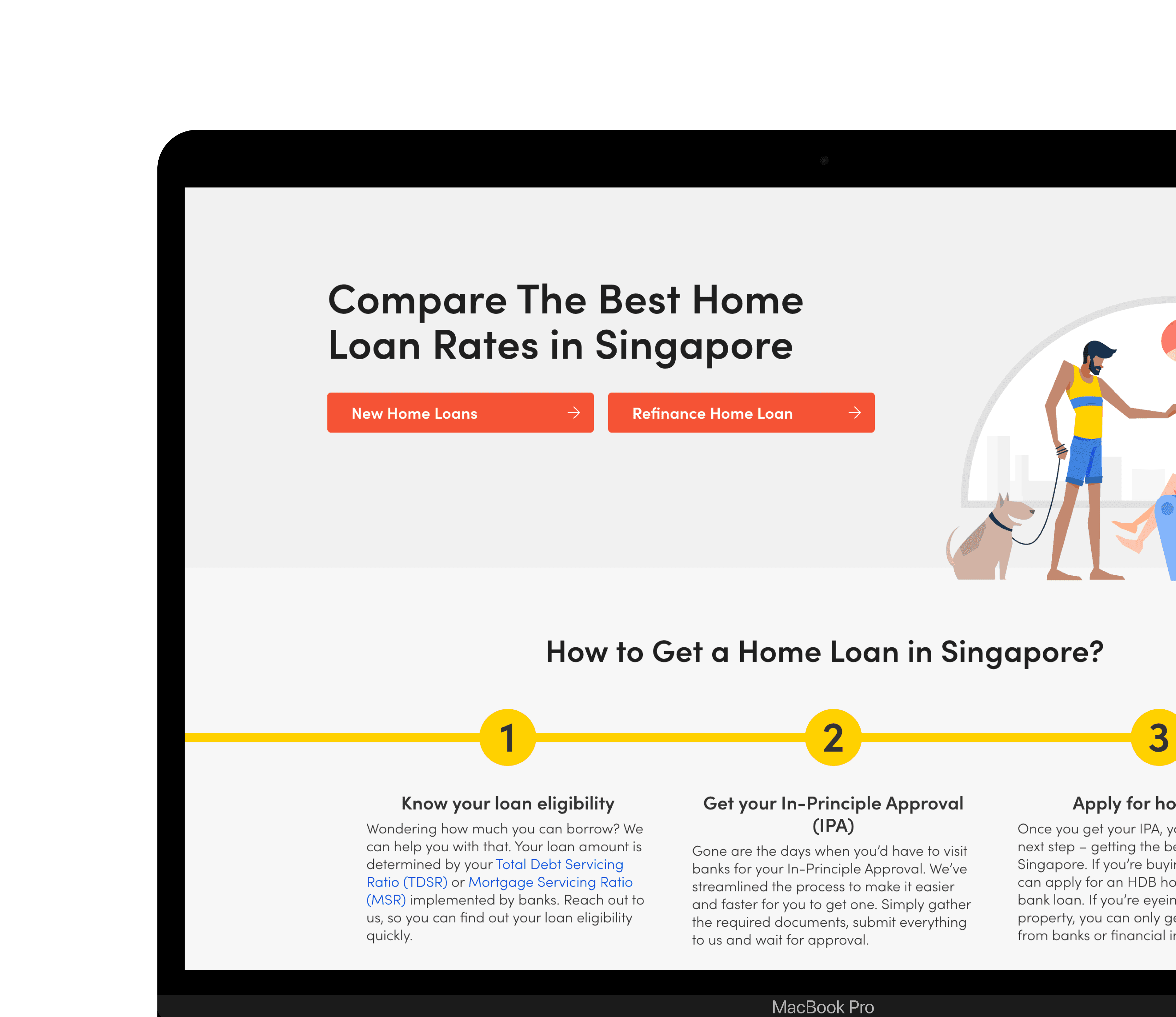

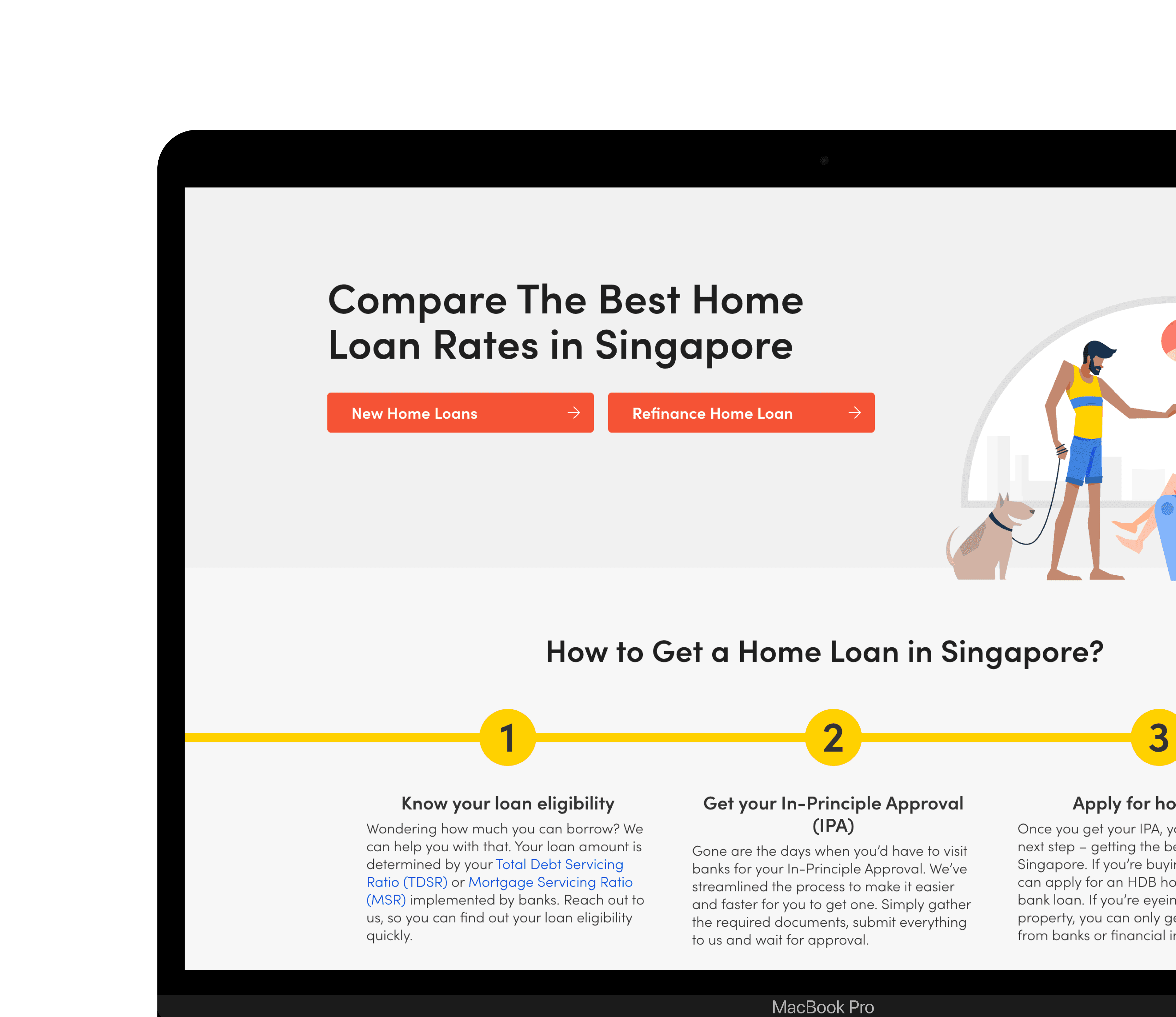

The MoneySmart Home Loans website aimed to simplify mortgage comparisons, offering users a way to find the lowest rates across banks.

However, despite promoting attractive rates, the homepage struggled to convert visitors into leads. As Lead Product Designer, I led a redesign to address this.

The Challenge

The MoneySmart Home Loans website aimed to simplify mortgage comparisons, offering users a way to find the lowest rates across banks.

However, despite promoting attractive rates, the homepage struggled to convert visitors into leads. As Lead Product Designer, I led a redesign to address this.

"Increase leads generated from the Homepage."

The Ask

"Increase leads generated from the Homepage."

The Ask

Current User Journey

The existing process required users to click a “Compare Rates” call-to-action (CTA) and complete a contact form to access the comparison service. This form submission qualified them as a lead for follow-up by a MoneySmart mortgage specialist.

Current User Journey

The existing process required users to click a “Compare Rates” call-to-action (CTA) and complete a contact form to access the comparison service. This form submission qualified them as a lead for follow-up by a MoneySmart mortgage specialist.

Despite high traffic, the low form completion rate signaled a problem. To understand why, I led research into website data, sales process, and competitor analysis.

Despite high traffic, the low form completion rate signaled a problem. To understand why, I led research into website data, sales process, and competitor analysis.

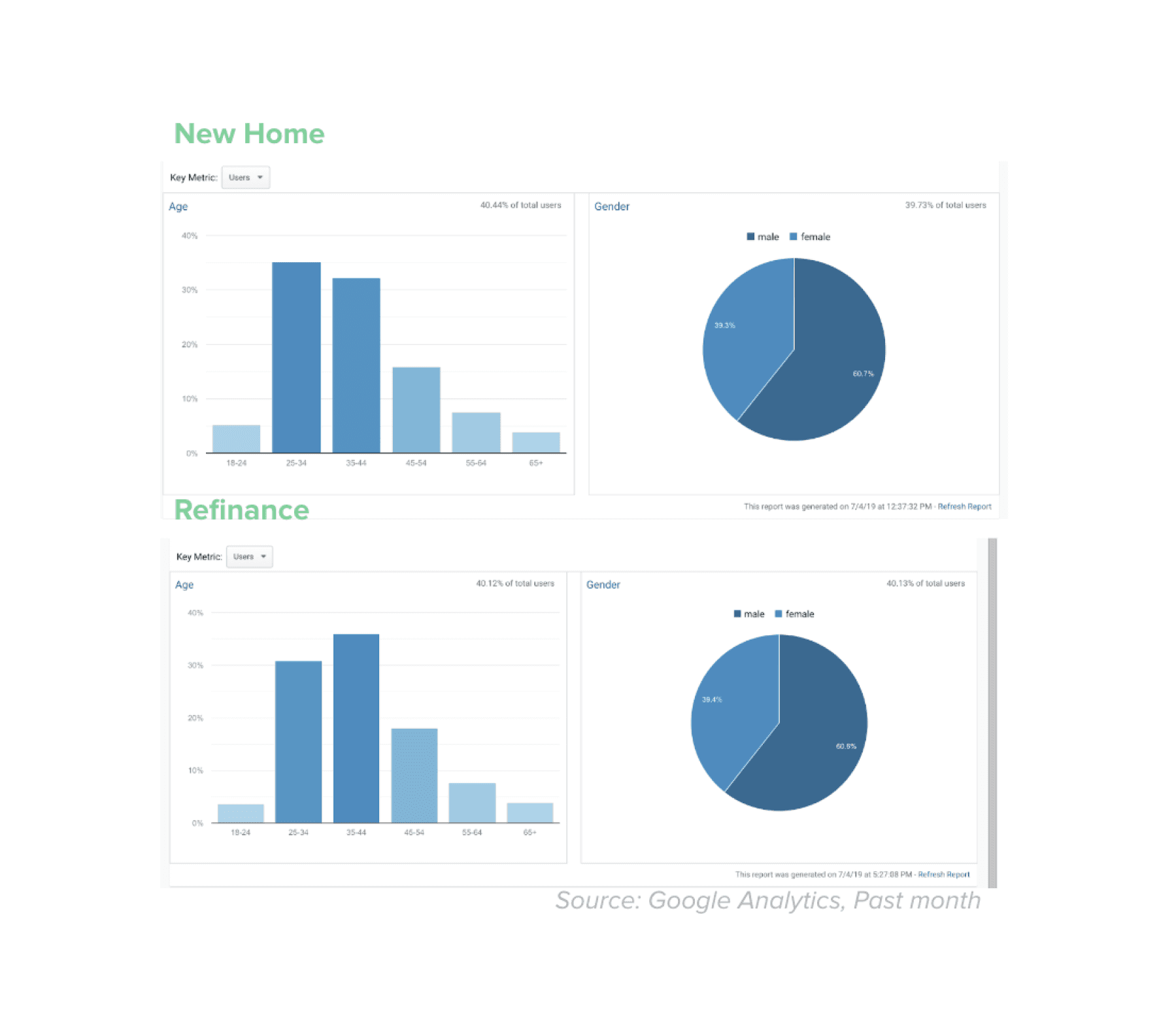

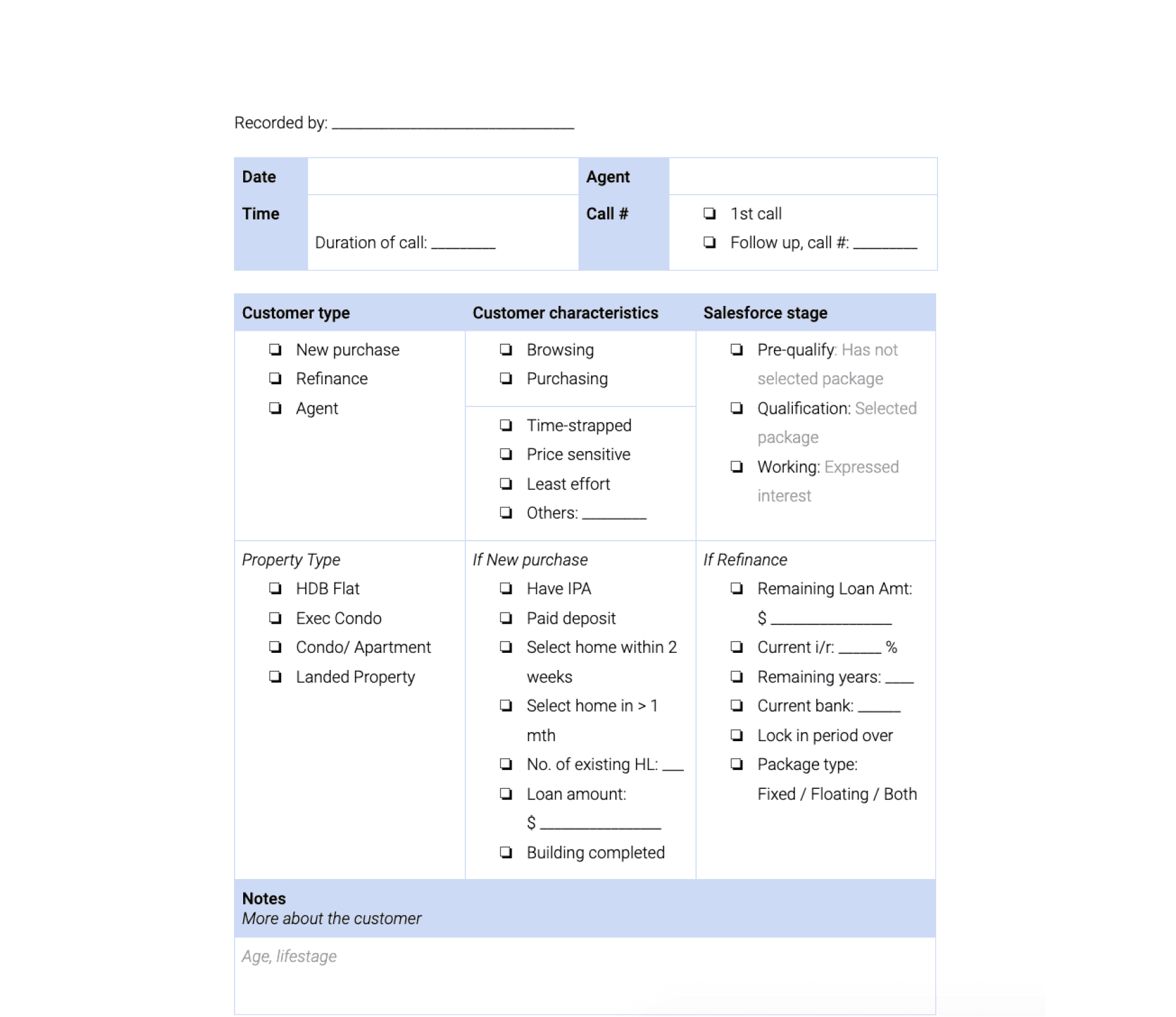

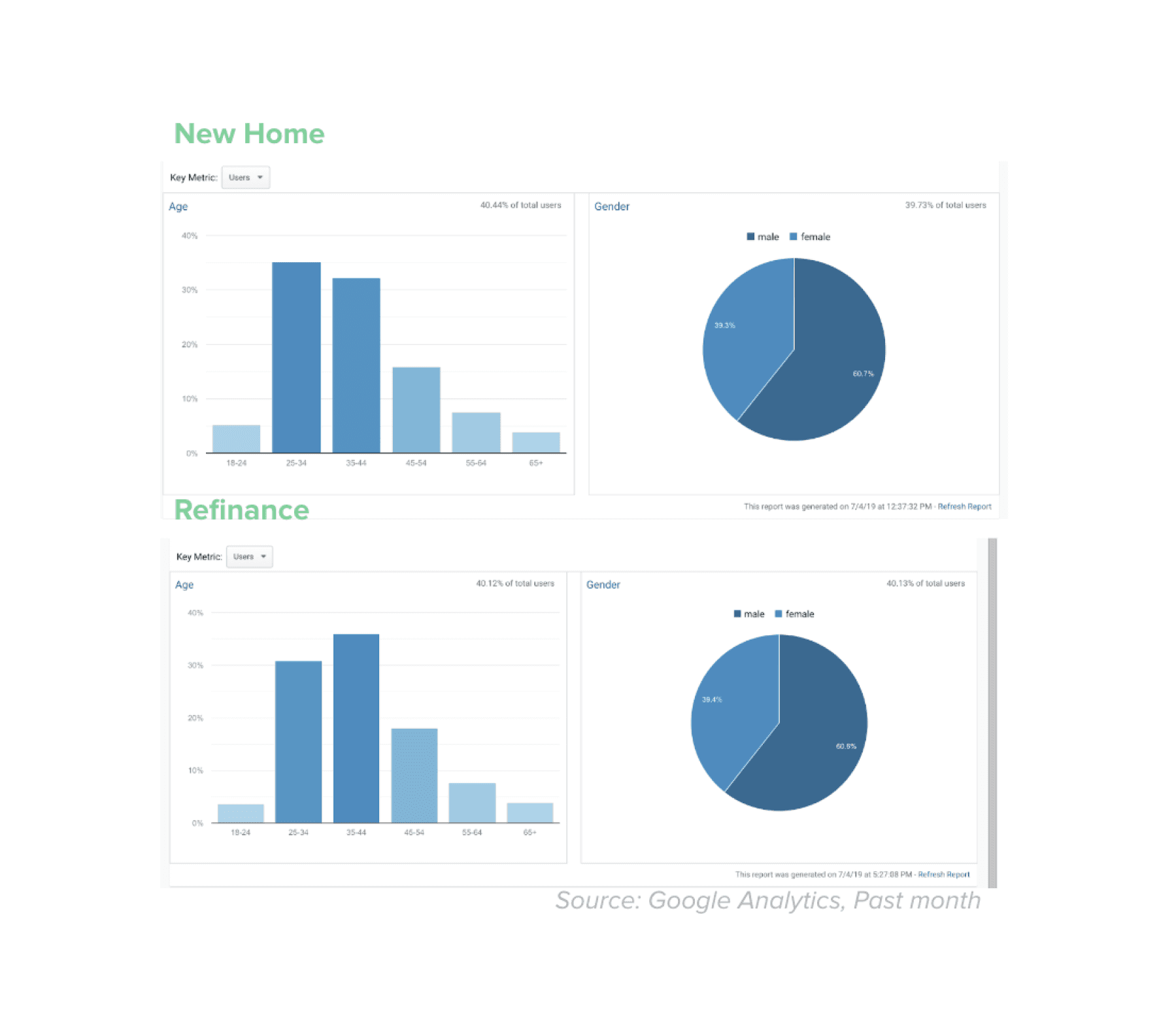

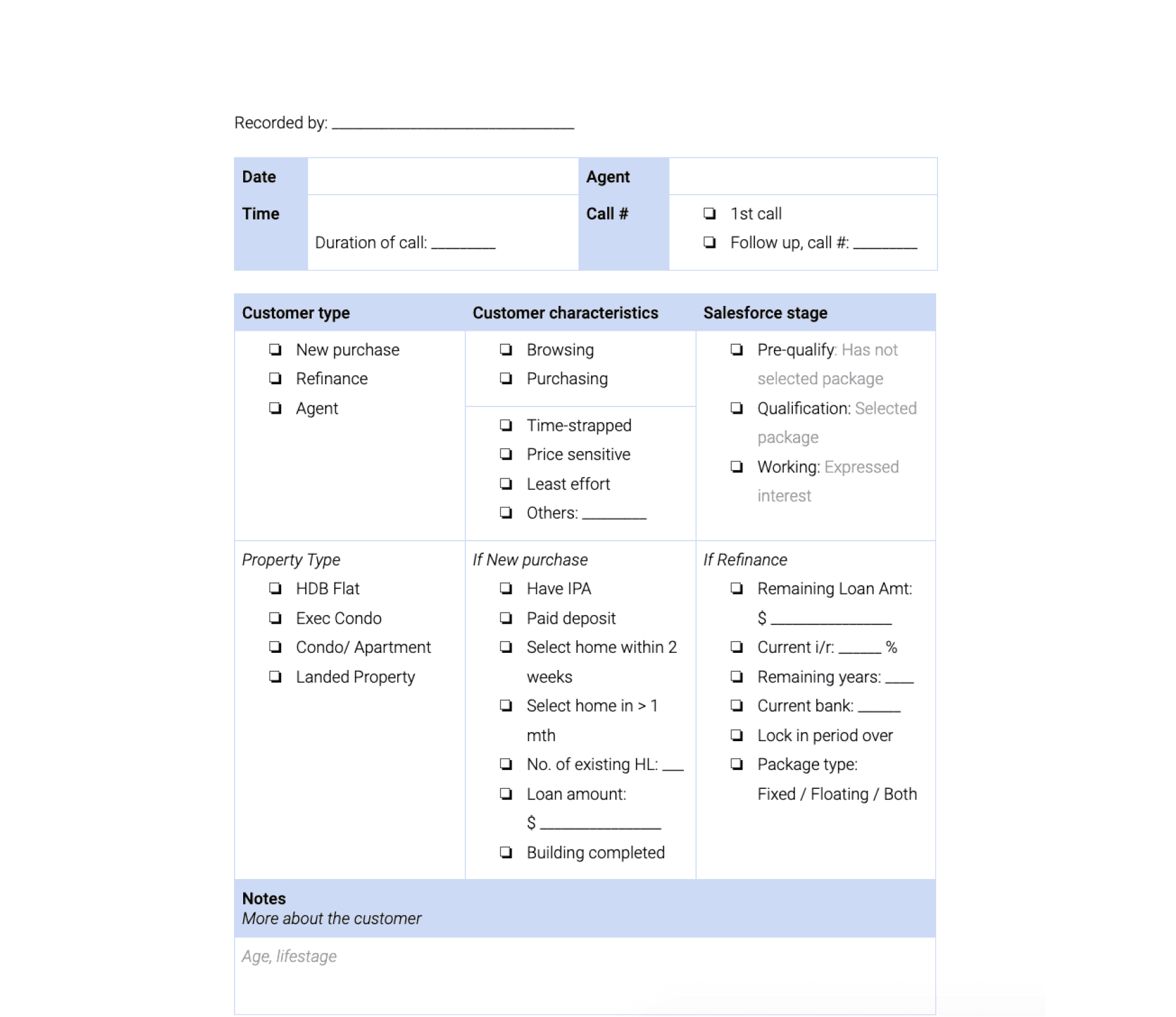

Web Analysis

Sales Process Analysis

Web Analysis

Sales Process Analysis

This research revealed critical insights that shaped the redesign:

This research revealed critical insights that shaped the redesign:

1. Beyond Rates

We discovered that users need more than just a rate comparison tool. The lowest interest rate doesn't always equate to the "best" loan for an individual, as factors like loan tenure and rate type can influence the total loan repayment. First time shoppers often need guidance on how to select a home loan, information a rate comparison tool won't provide.

1. Beyond Rates

We discovered that users need more than just a rate comparison tool. The lowest interest rate doesn't always equate to the "best" loan for an individual, as factors like loan tenure and rate type can influence the total loan repayment. First time shoppers often need guidance on how to select a home loan, information a rate comparison tool won't provide.

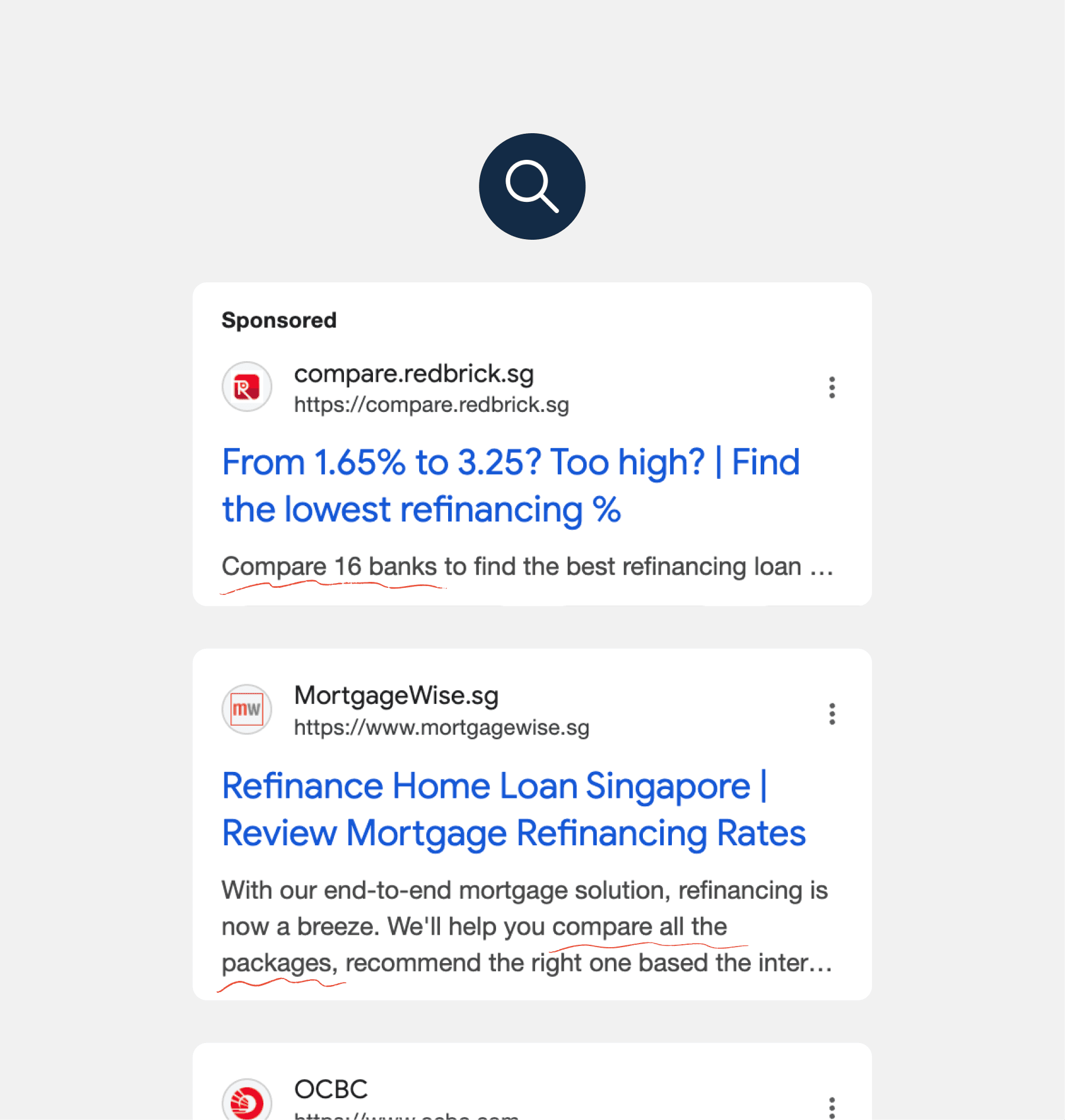

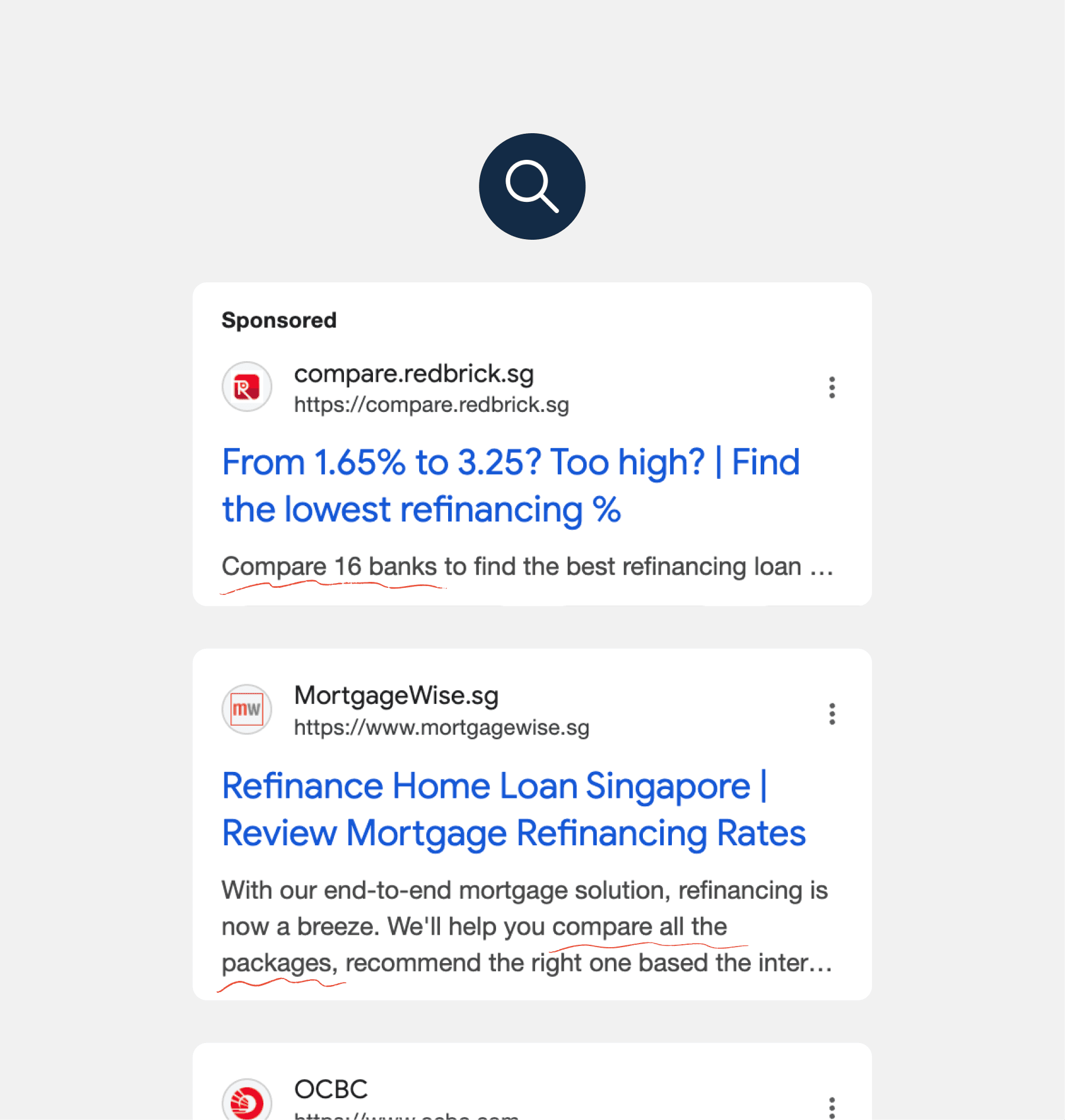

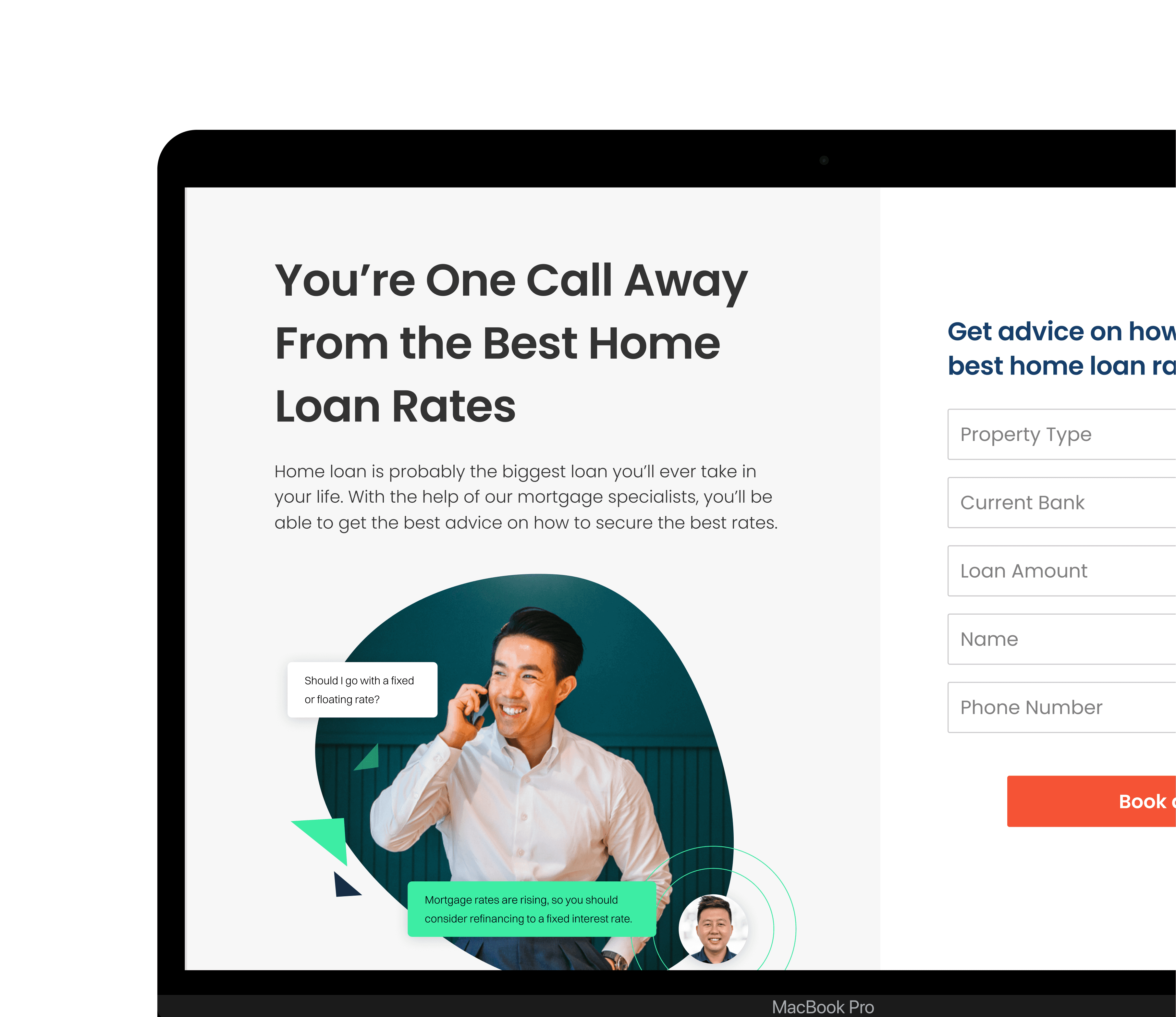

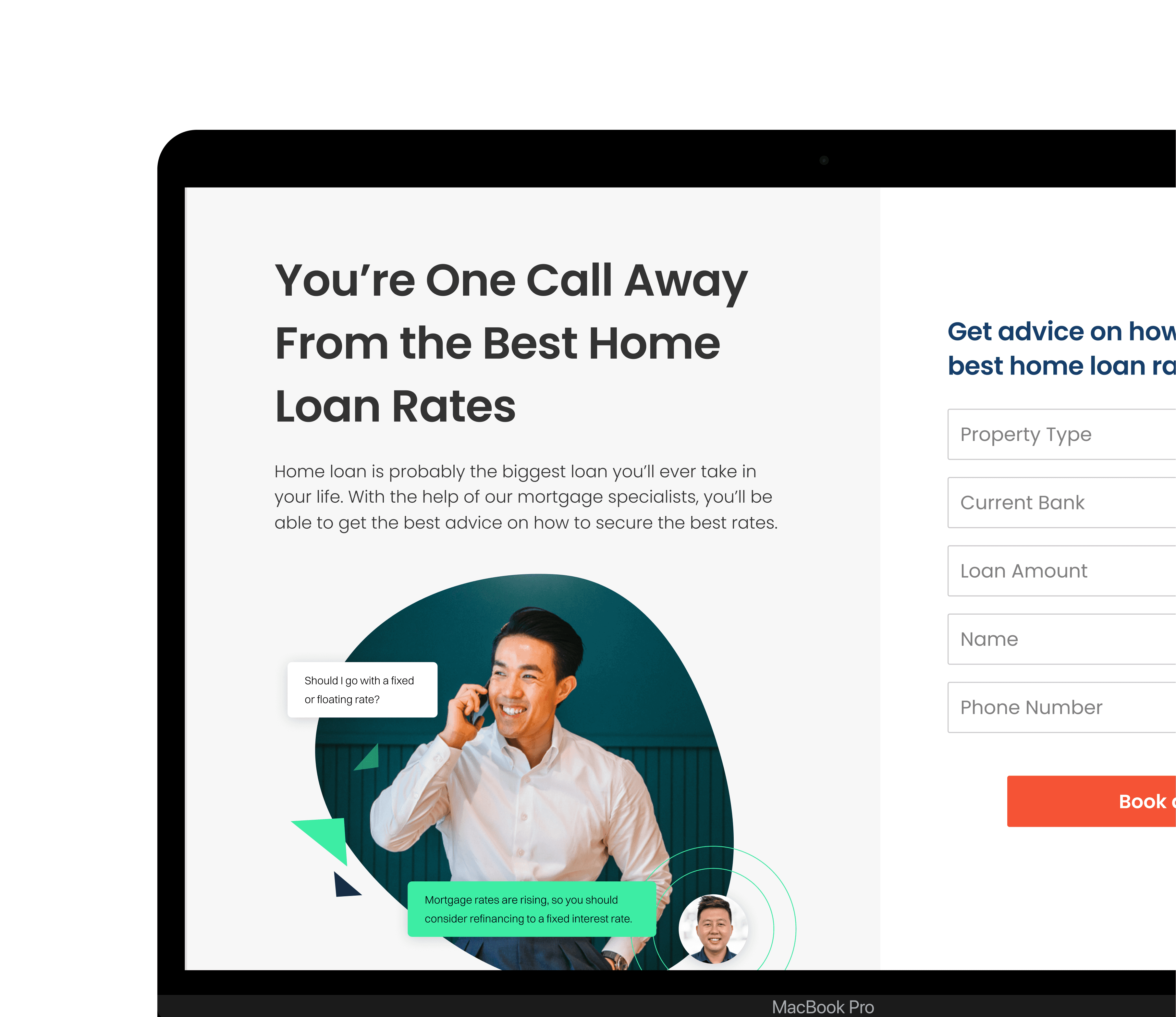

2. Expert Advantage

Competitive analysis showed that while many platforms offered similar rate comparison tools, MoneySmart had a unique asset — its mortgage specialists. These experts offered invaluable guidance, helping customers navigate rates, subsidies, and loan packages based on individual needs.

2. Expert Advantage

Competitive analysis showed that while many platforms offered similar rate comparison tools, MoneySmart had a unique asset — its mortgage specialists. These experts offered invaluable guidance, helping customers navigate rates, subsidies, and loan packages based on individual needs.

This insight highlighted an opportunity to differentiate MoneySmart as an expert-driven platform, beyond a comparison engine.

This insight highlighted an opportunity to differentiate MoneySmart as an expert-driven platform, beyond a comparison engine.

3. Casual Browsers

Our data indicated that majority of our visitors were casual browsers without an immediate need to purchase. The lack of a system to nurture these potential customers posed a risk of losing them to competitors when they were ready to commit.

3. Casual Browsers

Our data indicated that majority of our visitors were casual browsers without an immediate need to purchase. The lack of a system to nurture these potential customers posed a risk of losing them to competitors when they were ready to commit.

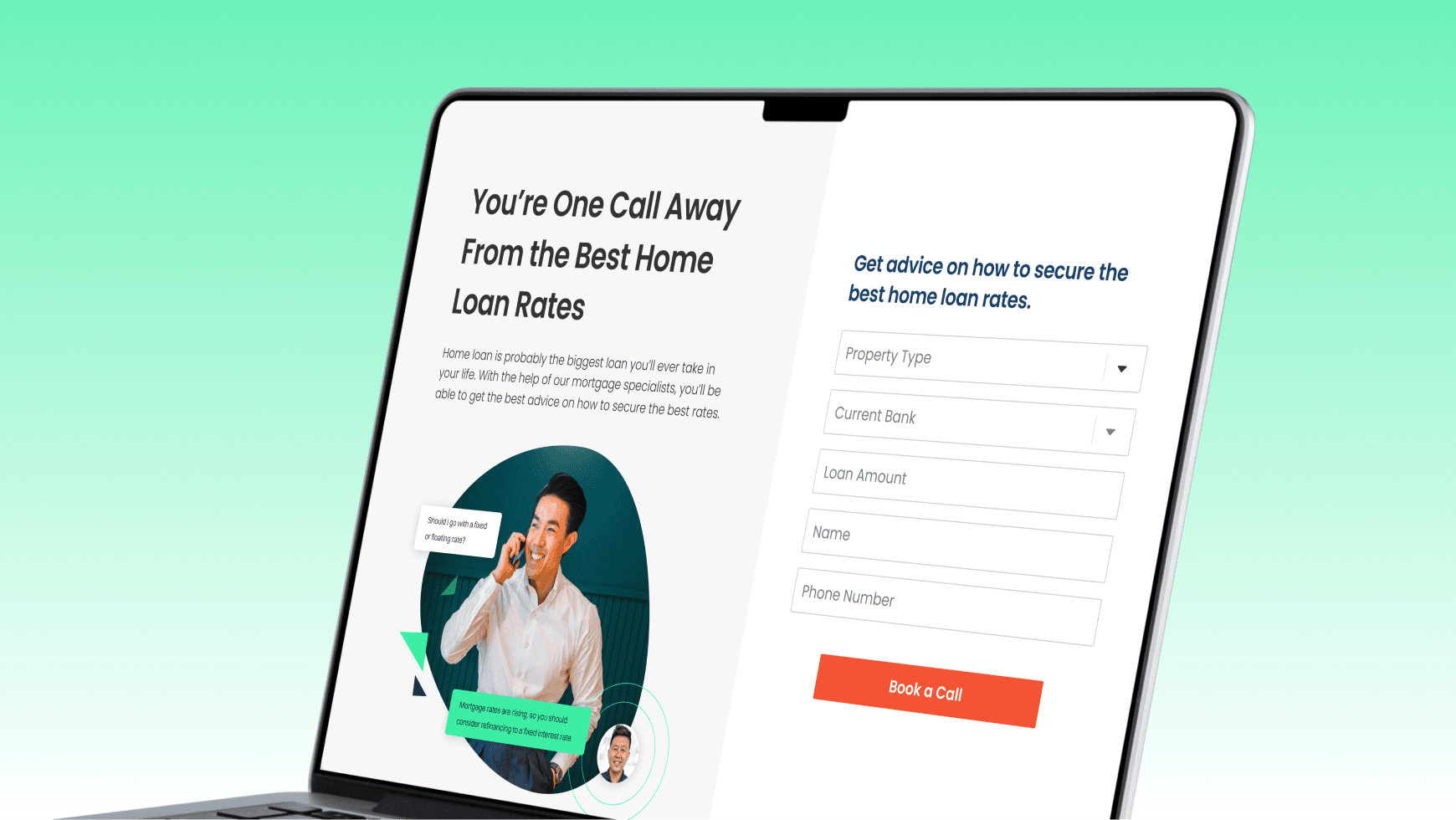

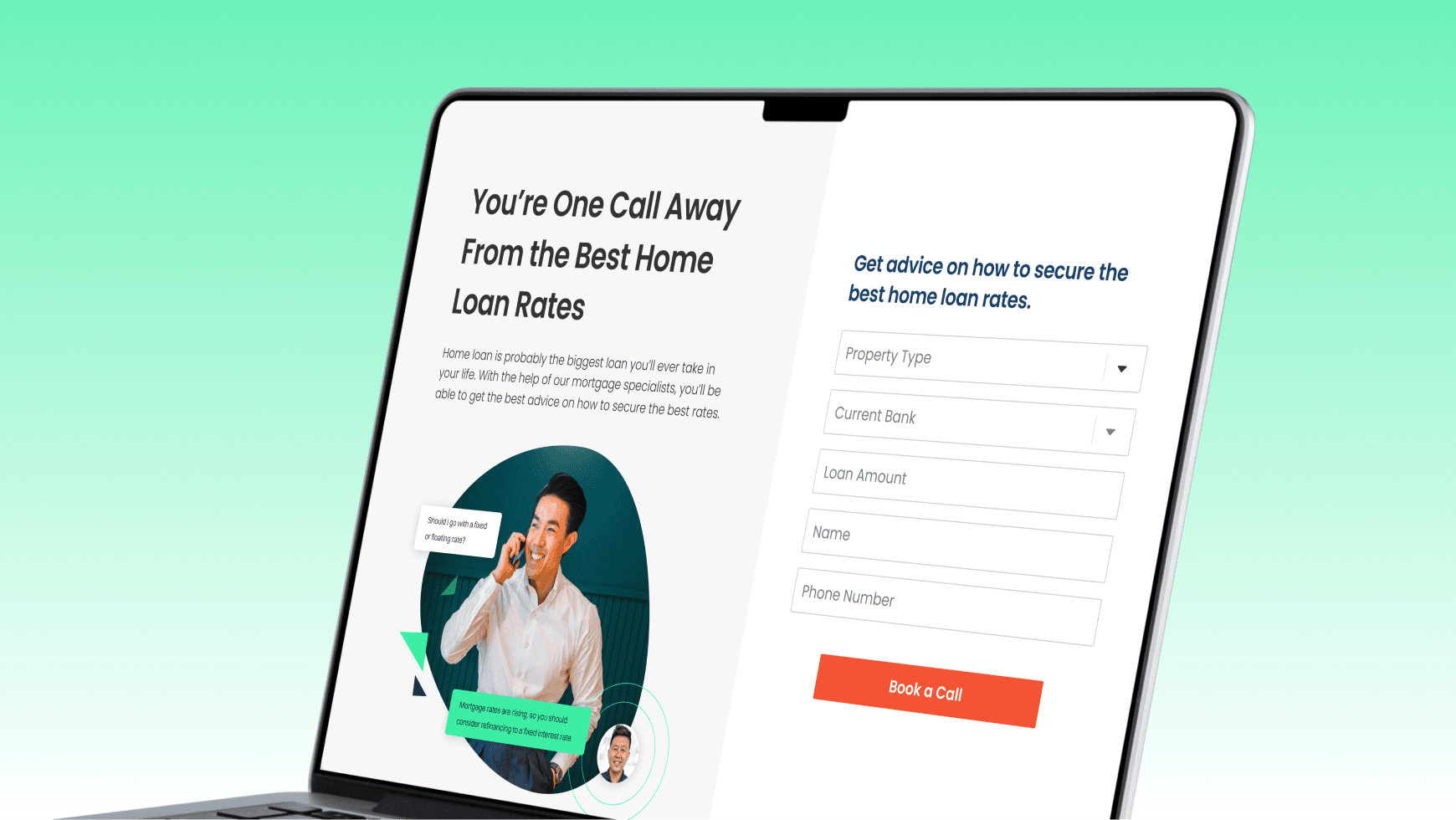

Based on the need for expert guidance [from Findings (1) & (2)], I redesigned the homepage to prioritize "Book a Call" as the primary CTA. This shift in focus aimed to highlight our specialists' expertise and personalized advice over "Compare Rates".

Based on the need for expert guidance [from Findings (1) & (2)], I redesigned the homepage to prioritize "Book a Call" as the primary CTA. This shift in focus aimed to highlight our specialists' expertise and personalized advice over "Compare Rates".

Old Value Proposition

New Value Proposition

Old Value Proposition

New Value Proposition

The result was a 25% increase in CTA click-through rates, confirming user demand for expert advice which they could not find on other platforms.

The result was a 25% increase in CTA click-through rates, confirming user demand for expert advice which they could not find on other platforms.

Extending to CRM

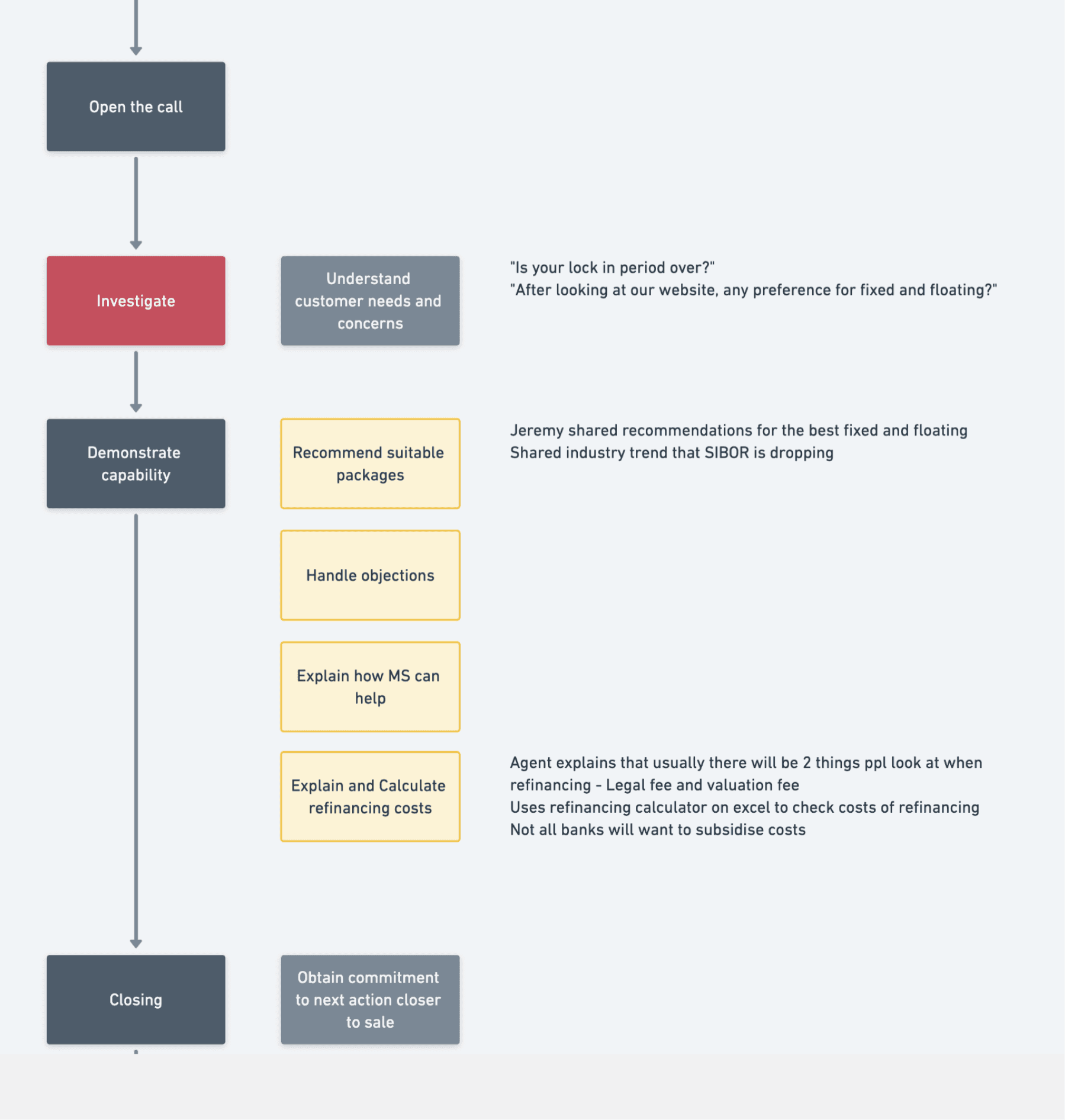

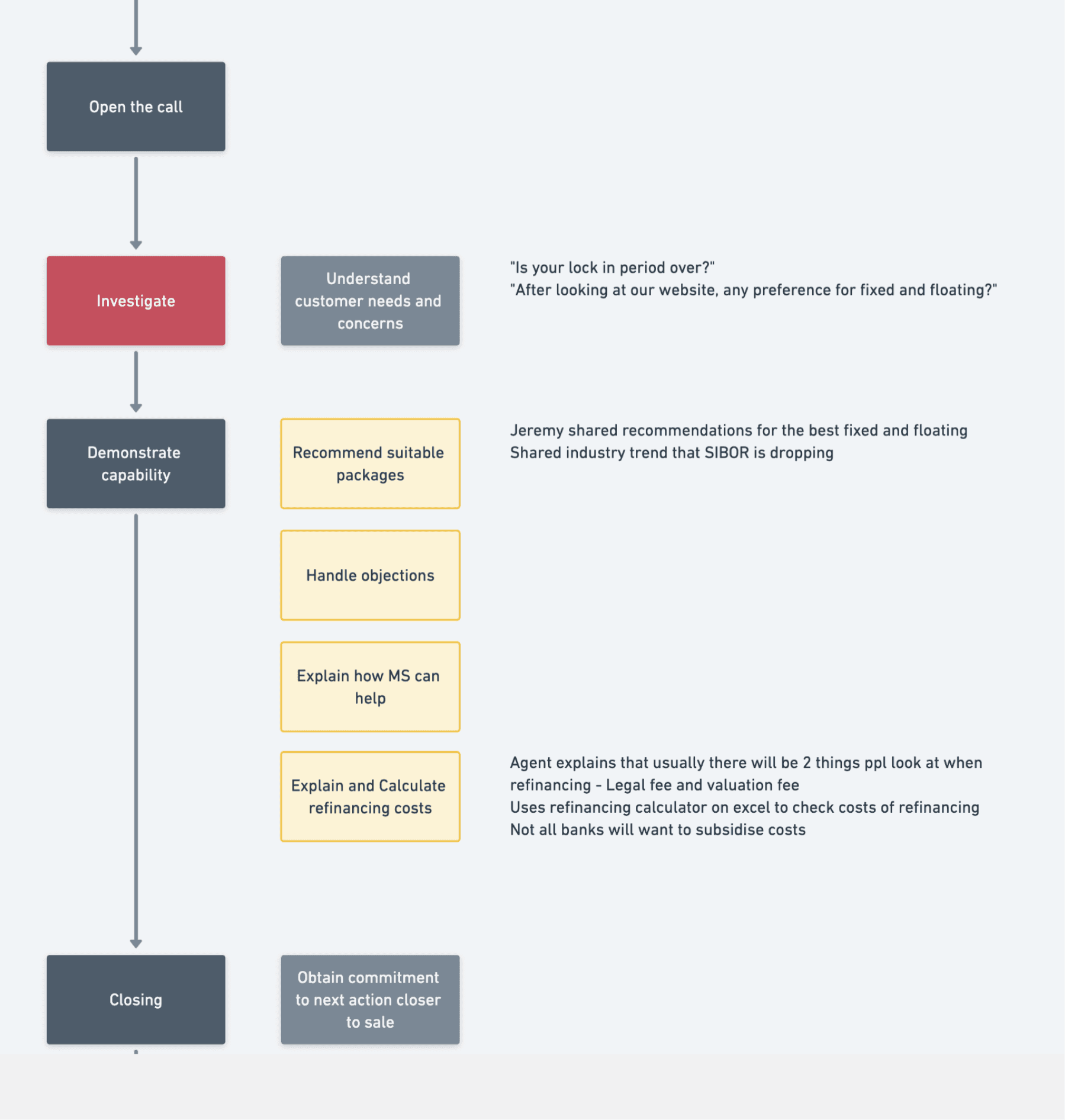

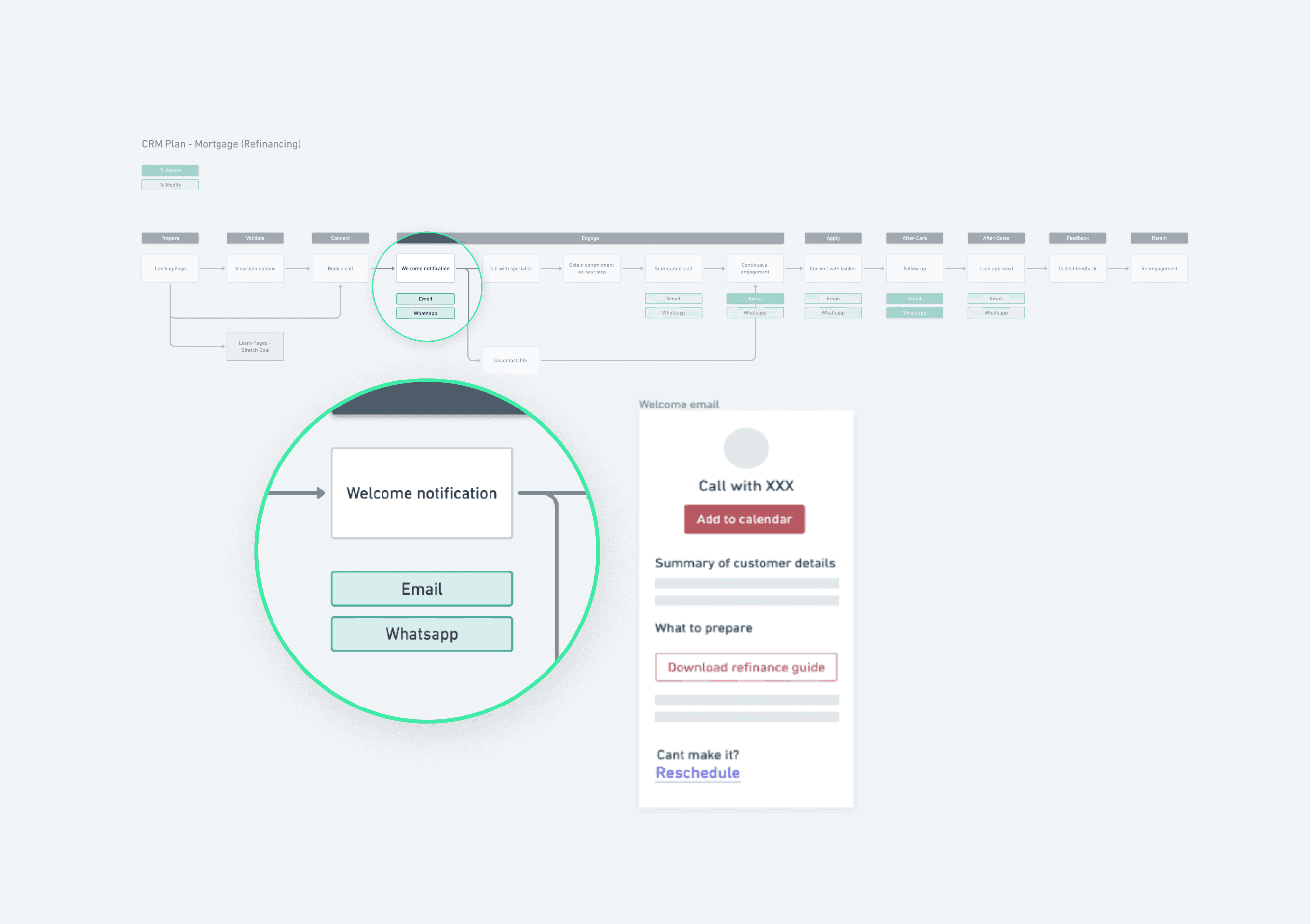

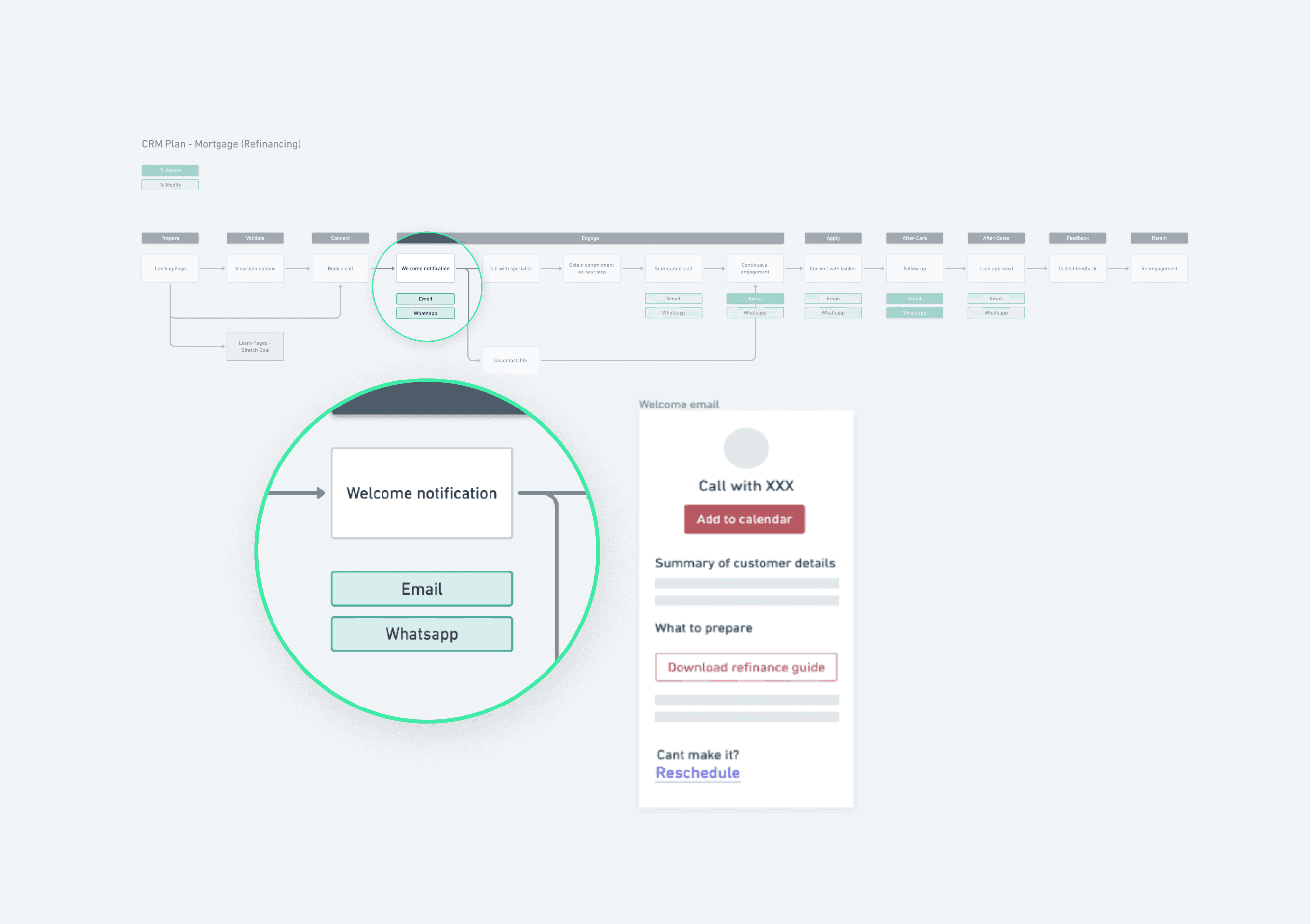

To address the challenge of casual browsers [Finding (3)], I collaborated with the Marketing team to roll out an automated CRM strategy across Email and WhatsApp Messaging.

Extending to CRM

To address the challenge of casual browsers [Finding (3)], I collaborated with the Marketing team to roll out an automated CRM strategy across Email and WhatsApp Messaging.

This system delivered educational content and personalized follow-ups at key points in the customer's journey, continuously engaging with them till they are ready to commit.

This system delivered educational content and personalized follow-ups at key points in the customer's journey, continuously engaging with them till they are ready to commit.

Old Email

New Email

Old Email

New Email

"The redesigned homepage and automated CRM strategy helped us to capture and nurture our leads more effectively."

Product Manager @ MoneySmart

"The redesigned homepage and automated CRM strategy helped us to capture and nurture our leads more effectively."

Product Manager @ MoneySmart